It’s the business tax incentive pot of gold that keeps on giving. Section 179 of the IRS tax code pays your business to invest in itself. In 2021 the deduction limit is higher than ever: $1,050,000. The full purchase price of equipment bought and put in service by December 31 can be deducted under Sec. 179. Moreover, businesses can take advantage of a 100% depreciation bonus on both new and used equipment, if costs exceed $1,050,000 but are less than $2,620,000.

This generous deduction covers a broad range of equipment, including:

- Computers, hardware peripherals, and software, including RFID systems

- Machinery

- Office furnishings, including file storage systems and lockers

- Office equipment

- Tangible personal property used in business

- Property attached to your building that is not part of your building, such as a warehouse rack system

And there’s more good news. If you lease or finance the equipment, the full price is deductible immediately. You may stretch payments over several years, but you get the deduction in Year 1.

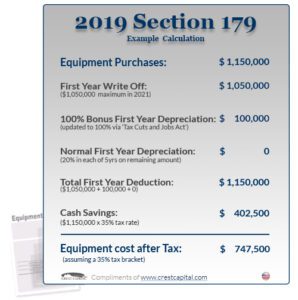

Take a look at this example:

There are a few restrictions under Sec. 179. Real estate does not qualify, nor does equipment acquired by gift or from a relative. And the equipment, whether new or used, must be new to you.

Most important: The equipment must be put in service, not just purchased, by December 31.

If you have been considering an equipment purchase, now is the time to act. Vendors with a quick-ship program (like NOS) can deliver and set up new equipment in time for you to put your new purchase into use ahead of the deadline. Grab the Sec. 179 gold and enjoy the tax deduction as well as the benefits of the new equipment.

Photo © Syda Productions / AdobeStock

Recent Comments